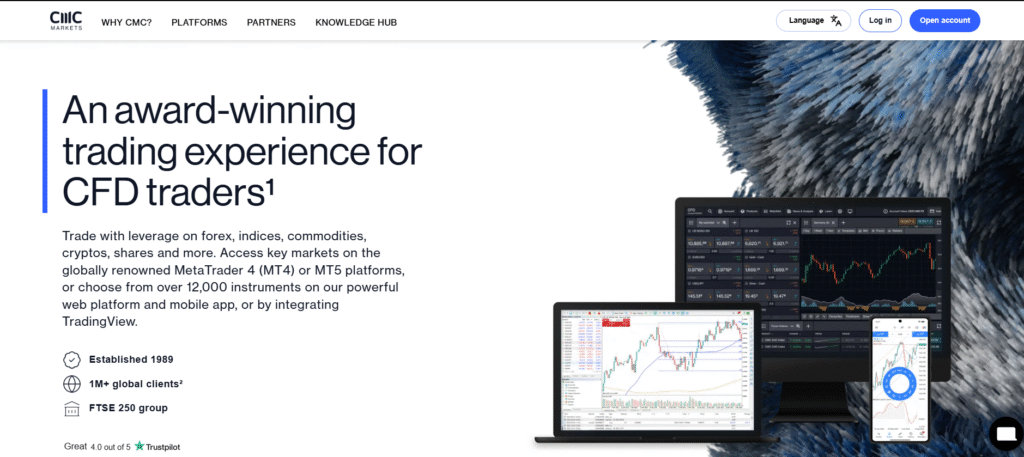

Founded in 1989, CMC Markets provides its clients with local expertise, backed by the security and financial strength of a global company.

CMC Markets is a well-regarded entity within the online financial trading arena, boasting a robust heritage from 1989. The company has expanded its global reach in the United Kingdom by establishing offices in crucial financial hubs like Australia, Singapore, and Canada.This expansive international footprint is the firm’s sizable customer base and its dedication to serving a broad spectrum of clients.

Its regulatory structure will reassure traders considering CMC Markets. It is supported by monitoring from numerous Tier-1 agencies such as the FCA, ASIC, and MAS, demonstrating the broker’s commitment to high financial standards and customer protection measures.CMC Markets’ popularity is bolstered by its broad offers, which comprise a wide range of tradable commodities from FX to cryptocurrencies, stocks to treasuries. This variation guarantees that traders with varying tastes can access various markets.

Furthermore, the broker’s technological infrastructure is excellent; platforms like MetaTrader 4 and the Next Generation trading platform provide customers with powerful tools for market analysis and trade execution.The availability of a demo account is a clever feature that allows novice traders to become acquainted with the complexities of trading without incurring financial risk.

CMC Markets Summary

| 🔎 Broker | 🥇 CMC Markets |

| 📈 Established Year | 1989 |

| 📉 Regulation and Licenses | BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA |

| 5️⃣ Ease of Use Rating | 5/5 |

| 🎁 Bonuses | ✅Yes |

| ⏰ Support Hours | 24/5 |

| 📊 Trading Platforms | MetaTrader 4, Next Generation, CMC Markets App |

| 📌 Account Types | CFD, Spread Betting, Corporate |

| 🪙 Base Currencies | GBP, EUR, USD, AUS, CAD, NOK, NZD, PLN, SEK, SGD |

| 📍 Spreads | From 0.3 pips |

| 💹 Leverage | 1:30 |

| 💴 Currency Pairs | 330+; major, minor, and exotic |

| 💵 Minimum Deposit | 0 USD |

| 💶 Inactivity Fee | ✅Yes |

| 📈 Website Languages | English, French, German, Italian, Norwegian, Polish, Spanish, etc. |

| 📉 Fees and Commissions | Spreads from 0.3 pips, commissions from 0.1% per share |

| 📊 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States, Belgium, and others |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, indices, commodities, crypto CFDs, shares, share baskets, treasuries, ETFs |

| 🚀 Open an Account | 👉 Click Here |

Security Measures

CMC Markets prioritizes the security of its clients’ assets and information by implementing a thorough set of procedures.

The company adheres to tight regulatory compliance, having been approved and regulated by top-tier regulatory agencies such as the Financial Conduct Authority (FCA) in the United Kingdom, which sets high standards for financial activities and trader safety.

Furthermore, customer funds are held in segregated accounts at trustworthy banks, separate from the company’s funds. This segmentation is critical for safeguarding clients’ funds in the event of the company’s bankruptcy.

Account Types

| 🔎 Account Types | 🥇 CFD | 🥈 Spread Betting | 🥉 Corporate |

| 🩷 Availability | All | UK | Institutional traders |

| 📈 Markets | Forex – 330+ Indices – 80+ Commodities – 100+ Shares – 9,500+ Treasuries – 50+ ETFs – 10,000+ |

Forex – 330+ Indices – 80+ Commodities – 100+ Shares – 9,500+ Treasuries – 50+ ETFs – 10,000+ |

Forex – 330+ Indices – 80+ Commodities – 100+ Shares – 9,500+ Treasuries – 50+ ETFs – 10,000+ |

| 💷 Commissions | Minimum $10 | Minimum $10 | Flexible |

| 📉 Platforms | All | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 💹 Leverage | 1:30 | 1:30 | 1:30 |

| 💴 Minimum Deposit | 0 USD | 0 USD | 0 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here |

CFD Trading Account

The CMC Markets CFD Trading Account is designed for retail traders, allowing them to bet on price changes without owning the underlying asset. It provides access to over 9,500 assets, with cheap spreads such as 0.3 pips on EUR/USD and leverage ratios of up to 1:30.

Traders can benefit from fractional trading positions and technologies like customer sentiment and pattern detection.The account also allows for hedging, has a full instructional package, and charges fees on shares only, beginning at $10, making it a versatile option for people seeking a variety of investing choices.

Spread Betting Account

CMC Markets Spread Betting Account, offered exclusively to UK traders, enables tax-efficient speculation on a wide range of financial assets. Traders can gamble on price fluctuations per point, with leverage limited to 1:30.This account is similar to the CFD account regarding tradable asset range, spread, and instructional tools.

It also offers fractional trading, hedging, and sophisticated technologies such as customer sentiment research and pattern identification, all without capital gains tax. It makes it an appealing option for traders trying to optimize their tax efficiency.

Corporate Account

CMC Markets Corporate Account offers professional traders and institutions access to the same features as the Retail CFD Account. This account provides access to over 9,500 products, leverage of up to 1:30, and fractional trading, as does the retail account.Corporate clients get the same narrow spreads, extensive training materials, and superior trading tools.

Furthermore, the account allows telephonic trading market analyst insights and has no inactivity fees, making it a solid alternative for corporate entities seeking high-level trading services and resources.

Demo Account

CMC Markets’ Demo Account provides an instructional and practice environment for traders. Traders may get to know CMC Markets’ platforms, try different trading techniques, and evaluate the broker’s services without risking their money.

The demo account includes real-time market data and access to all trading tools accessible on genuine accounts, making it an ideal preparation tool for novices or those wishing to explore new markets.

Trading Platforms and Software

MetaTrader 4

CMC Markets’ MetaTrader 4 platform is renowned for its analytical capabilities. It boasts an extensive array of charts, technical indicators, and comprehensive pricing research tools.

It also facilitates automated trading through expert advisors, enabling traders to implement their strategies with minimal manual intervention.The platform’s accessibility is noteworthy. It is compatible with multiple operating systems on desktop, catering to a broad spectrum of traders who can harness its full suite of resources.

With its intuitive interface and robust functionalities, MetaTrader 4 is the preferred choice for traders searching for a comprehensive and tailored trading journey.

Next Generation

The Next Generation platform from CMC Markets has been meticulously crafted to serve the preferences of today’s traders. It stands out for its intuitive interface and state-of-the-art technology.

This platform is rich in customization options, including various chart styles, a module-based connectivity system, and a tool for identifying trading patterns.Its unique strength lies in its innovative trading strategies, offering various advanced order types and in-depth performance metrics. Being web-based, it ensures accessibility from any location, catering to traders of all skill levels and focusing on optimizing trading effectiveness and precision.

Broker App

Tailored for traders seeking mobility, the CMC Markets App replicates the full functionality of CMC’s desktop and web-based trading platforms.This includes powerful charting tools, live market data, real-time price notifications, and the ability to execute trades, manage your holdings, and monitor market conditions.

Its intuitive interface simplifies mobile trading, empowering you to stay in touch with the financial markets and oversee your transactions practically anywhere and anytime.

Fees, Spreads, and, Commissions

Spreads

Competitive spreads are a hallmark of CMC Markets, pivotal in delivering cost-effective trading solutions. Take, for instance, the EUR/USD forex pair, where traders can commence with spreads as minimal as 0.3 pips. This feature appeals to high-volume traders who can leverage these tight spreads.

CMC Markets’ function as a market maker is the key behind their ability to offer such competitive spreads, aligning their costs closely with market levels. This pricing structure caters to traders of all types, from frequent traders to those who favor a more deliberate, long-term trading style.

Commissions

Commission costs at CMC Markets vary according to the asset being exchanged. For share CFDs, the broker charges a fee of 0.10%, with a minimal price for lesser trading quantities. This charge structure is clear, allowing traders to assess the expenses of their trading activity simply.

The fee rates are competitive in the market, allowing traders to complete deals without significantly reducing their prospective earnings, which is especially important for those dealing with big volumes of shares.

Overnight Fees

Overnight fees or holding expenses apply to positions open after the daily cut-off time, normally 5 pm New York time. Depending on the direction of the position and the appropriate holding rate, these costs might be charged or credited to the trader.

CMC Markets calculates this charge using interbank lending rates and marks up or down for long or short positions. This can influence the profitability of trades kept for a lengthy period, making it an important factor for overnight traders.

Deposit and Withdrawal Fees

Deposit and withdrawal fees at CMC Markets are designed to promote trading activity. The broker does not charge fees for most payment methods, including credit/debit cards and electronic wallets, making it a cost-effective alternative for traders to fund and access their money.However, a cost of 15 GBP is applied for international bank wires, which traders should consider when moving funds to and from their trading accounts, especially if they conduct regular cross-border trades.

Inactivity Fees

Accounts that have not traded for over a year will be charged an inactivity fee. CMC Markets levies a monthly fee of 10 GBP (or currency equivalent) for inactive accounts.This cost is intended to encourage regular trading activity and account management, emphasizing the importance of traders being active or formally closing their accounts if they no longer want to trade.

Currency Conversion Fees

Currency conversion costs are significant for traders using currencies other than their account-based currency. CMC Markets charges a fee of up to 0.5% of a trade’s realized profit or loss when traders operate in markets denominated in a currency other than their accounts.

This fee is significantly higher than industry standards. Therefore traders who perform frequent currency conversions must include it in their cost estimates to efficiently control their trading expenditures.

Leverage and Margin

With leverage trading available at CMC Markets, traders can enter positions using a portion of the total trade value. It is essential to remember that this strategy can magnify both profits and potential losses, underscoring the importance of a thorough grasp of the accompanying risks.When trading on margin with CMC Markets, you must deposit a set percentage of the total amount of the deal, known as the margin requirement. For example, if you want to create a position for £10,000 and the margin rate for the instrument is 5%, you must deposit £500.

Keeping enough funds in your account to fulfill margin requirements is critical since going below them might result in a margin call, which requires you to deposit additional funds or cancel positions to pay the gap.CMC Markets offers various leverage ratios based on financial market and asset type. Leverage ratios in forex begin at 30:1, which is quite high, indicating a greater chance for profit and loss. Professional traders can use the leverage of up to 500:1.

Deposit and Withdrawal

| 🔎 Payment Method | 🌎 Country | 💴 Currencies Accepted | ⏰ Processing Time |

| 💴 Credit/Debit Card | All | Multi-currency | 1 – 5 days |

| 💵 Bank Transfers | All | Multi-currency | 1 – 2 days |

| 💶 Online Banking | All | Multi-currency | 1 – 2 days |

Educational Resources

CMC Markets offers the following educational resources:

- Educational Videos

- A variety of instructional articles

- Demo account

The glossary is essential for traders to become acquainted with trading and financial terms. Moreover, it improves knowledge of market comments, analysis, and instructional information.