Trading with LiteFinance means: high-performance platform, low floating spreads, market execution with no requotes, professional assistance and access to exclusive analytical materials and signals.

LiteFinance Summary

| 🗓 Established Year | 2005 |

| ⚖️ Regulation and Licenses | CySEC |

| 🪪 Ease of Use Rating | 4/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5, LiteFinance Social Platform, LiteFinance Mobile App |

| 🛍 Account Types | ECN, Classic |

| 🤝 Base Currencies | AUD, EUR, GBP, NZD, USD, CHF, CAD |

| 📊 Spreads | 0.0 pips |

| 📈 Leverage | 1:500 |

| 💸 Currency Pairs | 56; minor, major, and exotic pairs |

| 💳 Minimum Deposit | 50 USD |

| 🚫 Inactivity Fee | Yes, 10 USD after two months of inactivity on accounts with a <$100 balance |

| 🗣 Website Languages | English, Indonesian, Russian, Malay, Thai, Spanish, French, Portuguese, Chinese (Simplified), Arabic, Persian |

| 💰 Fees and Commissions | Spreads from 0.0 pips, commissions from $0.25 per share |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | Residents of EEA countries, the United States, Russia, Japan, Israel, and other regions. |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, commodities, index CFDs, energies, precious metals, shares |

| 🎖 Open an Account | Open Account |

Account Types

| ECN | Classic | |

| ✅ Availability | All; ideal for scalpers and day traders | All; ideal for casual traders |

| 🛍 Markets | All | All |

| 💸 Commissions | $0.25 per share $0.5 per Contract on Stock Indices $0.5 per lot on Energies $10 on Forex Major Pairs $20 on Forex Crosses $20 on Precious Metals $30 on Forex Minor Pairs 0.12% on Cryptocurrencies |

None; only the spread is charged |

| 💻 Platforms | All | All |

| 📊 Trade Size | 0.01 lots – 100 lots | 0.01 lots – 100 lots |

| 📈 Leverage | 1:1 – 1:500 | 1:1 – 1:500 |

| 💰 Minimum Deposit | 50 USD | 50 USD |

| 🎖 Open an Account | Open Account | Open Account |

ECN Account

Experienced traders seeking market execution with minimal spreads starting at 0.0 pips in exchange for the commission will find the ECN Account ideal. This account offers leverage of up to 1:500 and requires a minimum deposit of $50, providing direct access to liquidity providers. Traders can trade Forex, shares, commodities, indices, and social trading using MetaTrader 4 and 5 platforms.

The benefits include customizable lot size beginning at as low as 0.01 units alongside diverse choice base currencies while also enjoying negative balance protection- making it an attractive option for serious investors looking beyond traditional investment vehicles.

Classic AccountTailored for individual traders, the Classic Account eliminates commission fees and provides flexible spreads from as low as 1.8 pips. This account type covers various trading products and platforms, such as MT4, MT5, and LiteFinance’s exclusive social trading platform. Traders can enjoy leverage up to 1:500 with only a $50 minimum deposit while being assured of no hidden charges – perfect for those who value transparency in pricing strategies.

On top of that, this account offers negative balance protection plus Islamic account conversion options alongside access to informative materials – attracting like-minded learners who appreciate openness about how their trades are executed at every step.

Demo Account

With the Demo Account, traders can practice and experiment with strategies without any financial risk. The platform allows access to MT4 and MT5 using virtual money, which accurately simulates the actual market situation.

Since this demo account has no expiration date, it serves as an ideal tool for continuous learning. With real-time market data, traders can try various platforms and instruments until they become confident. This teaching resource is essential for beginners looking to gain confidence while enabling experienced professionals to test new methods without risking their finances.

Islamic Account

The broker offers an Islamic Account tailored for Sharia-compliant traders with no interest obligations.

This swap-free solution applies to two account types – ECN and Classic – ensuring ethical trading principles by removing rollover interest charges on overnight holdings in alignment with the standards of Islamic finance. Not only does this account maintain a consistent leverage ratio, execution quality, and access to all products included as standard accounts, but it also eliminates spread-widening measures.

The inclusive system permits Muslim traders unrestricted market engagement without compromising their religious beliefs or values.

Deposit & Withdrawal Options

| 💳 Payment Method | 🏛 Country | ⚖️ Currencies Accepted | ⏰ Processing Time |

| Debit/Credit Card | All | Multi-currency | Unpublished by broker |

| Bank Wire Transfer | All | Multi-currency | Unpublished by broker |

| Perfect Money | All | Multi-currency | Unpublished by broker |

| M-PESA Kenya | Kenya | KES | Unpublished by broker |

| M-PESA Tanzania | Tanzania | TZS | Unpublished by broker |

| Africa Mobile Money | Ghana | GHS | Unpublished by broker |

| ADVCash | All | Multi-currency | Unpublished by broker |

Trading Instruments & Products

The broker offers the following trading instruments and products:

➡️Forex – The broker offers a comprehensive choice of 56 currency pairings, including major, minor, and exotic pairs, enabling traders to capitalize on global foreign exchange market dynamics. This extensive variety allows traders to participate in strategies across several markets, from the most traded pairings, such as EUR/USD, to less prevalent exotic pairs, diversifying their trading portfolio.

➡️Precious Metals – Traders can trade five precious metals, which normally include gold and silver but may also include platinum and palladium. These assets are often employed to hedge against inflation and currency depreciation, providing a haven alternative during economic turmoil.

➡️Energies – Overall, he broker allows you to trade two types of energy products: crude oil and natural gas. These commodities are very volatile, creating many trading opportunities, and are critical for traders wishing to diversify their tactics beyond forex and metals.

➡️Global Stock Indexes – With 11 global stock indexes, traders may bet on wider equity market trends without trading individual equities. These indexes often contain benchmarks such as the S&P 500 and NASDAQ, which reflect important market sectors and economies.

➡️CFD on Indices – CFDs on indices allow traders to speculate on the price movement of an index without owning the underlying assets, providing a mechanism to trade on the overall performance of an index.

➡️Cryptocurrencies – Additionally, the broker offers a diverse range of 65 cryptocurrencies for trading, allowing access to one of the most active and quickly increasing marketplaces. This enables traders to speculate on the price swings of various digital currencies, including Bitcoin, Ethereum, and others, catering to the rising interest in cryptocurrency.

MetaTrader 4

The MT4 trading platform is renowned for its intuitive interface and impressive functionality.

Traders of all levels benefit from the extensive selection of analytical features, including 50+ pre-installed indicators, nine timeframe options for in-depth price analysis, and many drawing tools. The secure connection offers convenience with one-click trades and automated trading capabilities via Expert Advisors. At the same time, MetaTrader Market access provides additional resources to enhance your experience within the MQL4 community network.

The built-in encryption ensures safe transaction processing, further solidifying the broker’s reputation as a reliable trader choice.

MetaTrader 5

The broker offers traders seeking a comprehensive multi-asset platform that covers forex, equities, and commodities through CFDs the sophisticated features and capabilities of MetaTrader 5.

Boasting advanced analytical tools such as an economic calendar with 21 timeframes over 80 technical indicators for thorough market studies, MT5 is far superior to its predecessor. With complete support for various order types, including trailing stop orders, and extensive EA testing abilities via its strategy tester feature, it is perfect for those looking to test their strategies while enjoying maximum functionality in trading operations.

cTrader

cTrader’s intuitive and user-friendly interface is famous for facilitating speedy order execution and delivering advanced charting functionalities. Furthermore, many traders prefer this platform due to its superior order capabilities and Level II pricing – two features resonating with LiteFinance’s commitment to offering transparent prices and lightning-fast transaction processing.

Additionally, cTrader comes packed with comprehensive analytical tools and extensive charting suites- perfect supplements for scalpers and day traders seeking enhanced support from the broker while employing their trading strategies.

Trading App

The Trading App is designed for forex traders who prefer the convenience of portable devices. This mobile solution makes monitoring accounts and making trades while on the go even more accessible.

The app incorporates essential functionalities such as live quotes, interactive charts, and an extensive suite of trading orders that align with LiteFinance’s dedication to providing a dynamic trading experience. In addition, traders can access markets efficiently through its user-friendly interface, utilizing analytical tools at any time from anywhere they may be located to manage their investments effectively.

Social Trading Platform

The Social Trading Platform offers a unique solution for traders to emulate and replicate the strategies of skilled market players within LiteFinance’s network.

This platform is perfect for novice or seasoned traders seeking alternative trading methods by leveraging collaborative knowledge from a community of experts. The tool is an ideal supplement to their education-based approach; it provides insights into trader performance evaluation and risk mitigation measures while providing realistic learning opportunities with potential profits.

Additionally, integrating social elements in this process bolsters inclusivity and democratization – making trading more accessible and engaging.

Spreads

The spread system is designed to cater to a wide range of traders, offering competitive advantages that are especially advantageous for those using their ECN account. With spreads starting as low as 0.0 pips, this narrow margin can be incredibly beneficial for high-volume traders and individuals utilizing techniques like scalping, where each pip becomes significant.

For Classic account holders who prefer commission-free trading or infrequent trades, the company offers spreads beginning at 1.8 pips. The variety of available spreads highlights LiteFinance’s dedication to accommodating diverse styles and methods in trading while also providing value for both cost-conscious customers and casual investors alike.

Commissions

The broker offers commission costs tailored to suit the needs of active and professional traders, with fees starting at $0.25 per share on their ECN account. This demonstrates LiteFinance’s commitment to providing an affordable trading environment for its users. The commission charges depend upon the type of product traded – major Forex pairs incur a cost as low as $10- in line with LiteFinance’s fair and transparent pricing approach.

By adopting this model, traders can effectively monitor their anticipated transaction expenses, thereby gaining control over their overall spending while executing trades accurately within budget constraints.

Overnight Fees

Overnight fees impact traders who hold positions open for more than a day. The costs may fluctuate according to market conditions, potentially impacting forex strategy. Traders should note the trading platform’s opportunity for triple swaps on Wednesday and Thursday evenings, as this could affect profitability through increased fees.

With its transparent fee structure, the broker enables traders to anticipate potential transaction expenses and plan accordingly.

Leverage and Margin

Overall, the broker offers leverage and margin trading as important features of its forex and cryptocurrency trading platform. Additionally, the company explains that leveraging is like a loan given by the broker to traders in the realm of forex trading.

This method allows them to take on positions much larger than their initial investment, leading to significant gains or losses depending on market fluctuations. With LiteFinance’s 10:1 leverage ratio, for instance, traders could manage trades with an amount ten times greater than what they initially invested. While high leverages present more opportunities for savvy traders looking to maximize profits from smart trades, they raise asset risk levels significantly.

In contrast, margin trading involves acquiring financial products through borrowed funds from a broker. Initially implemented in stock transactions, this notion has been broadened by the broker to incorporate numerous digital assets and empower traders with leveraged positions in cryptocurrency markets. The provision of margin trading for crypto-assets exemplifies LiteFinance’s commitment to providing traders access to top-notch tools while facilitating leverage over volatile markets. Leveraging and margin trading are both important techniques for traders looking to expand their market exposure and increase potential earnings.

However, they must be aware of the risks involved in these methods that could amplify profits and losses. To make sure traders understand leverage and margin trading fundamentals before engaging in such high-risk yet rewarding tactics, they provide educational resources.

Educational Resources

The broker offers the following educational resources:

➡️LiteFinance Webinars – Moreover, these online seminars dive into Forex market theory and practice, given by expert traders with vast experience. The webinars are designed to assist traders in making educated judgments, answer tough queries, and grasp key trading principles.

➡️Forex Glossary – Overall, this is a comprehensive collection of Forex words and concepts that may help traders educate themselves with the specialized language used in forex trading.

➡️Forex books – The broker suggests books that provide insights into Forex from the viewpoint of expert traders. This may be very valuable for improving your market comprehension and trading abilities.

➡️Trading Strategies from Professional Traders – Additionally, the site allows users to access a variety of trading strategies offered by experienced traders, as well as practical information and approaches for use in various market conditions.

➡️Trader Reviews – Overall, traders may access reviews and comments from other users, creating a forum for community learning and sharing experiences.

➡️Demo Account – The broker provides a demo account feature that allows traders to test their trading methods in a risk-free environment using virtual money. This is especially advantageous for beginner traders who want to acquire expertise without financial risk.

➡️FAQ section – Moreover, a well-organized FAQ section covers typical inquiries and offers rapid answers to various issues or questions that traders may have concerning LiteFinance’s services and operations.

Security Measures

Overall, the broker employs rigorous security measures to safeguard its customers and provide a safe trading environment.

Firstly, they keep segregated accounts, keeping client funds separate from the company’s operating funds. This segmentation is critical when the firm has financial problems since it safeguards customers’ money. Furthermore, the broker is a member of the Investor Compensation Fund (ICF), which adds extra financial protection. The ICF seeks to reimburse customers if the company fails to meet its financial responsibilities, covering up to 20,000 EUR per client and providing a substantial safety net.

To secure customers’ data and transactions, they use an SSL certificate, which ensures that all data passed via its website is encrypted, preventing other parties from capturing sensitive information. Furthermore, the broker provides Two-Factor Authentication, which needs not just a password and username but also something only the user has, such as a physical token. A clear and thorough privacy policy is in place, describing how customer data is gathered, handled, and safeguarded. The company also issues risk alerts to traders to assist them in understanding the possible hazards involved with trading activity.

Finally, the broker provides Negative Balance Protection, guaranteeing that customers cannot lose more than their account balance. This is especially crucial in highly volatile trading settings when market moves might be unforeseen.

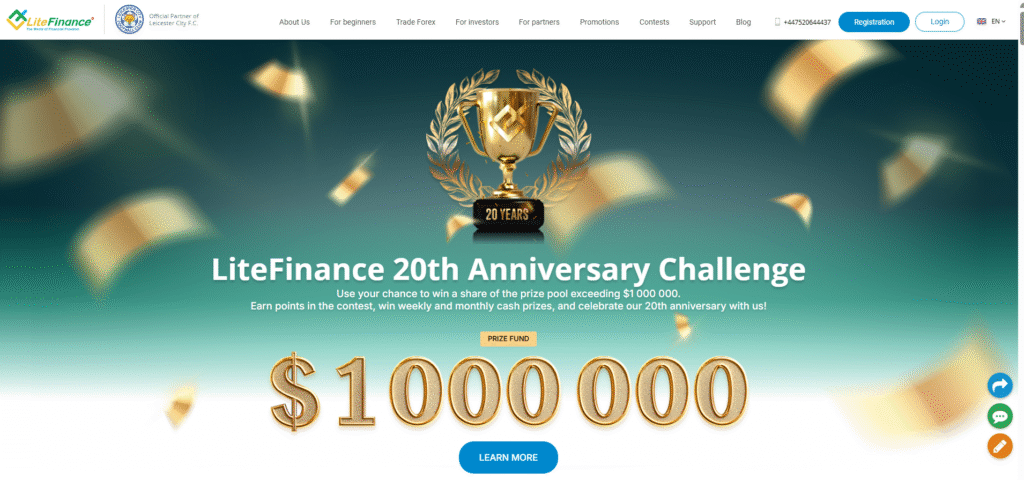

LiteFinance, founded in 2005, has been revolutionizing the foreign exchange industry by introducing cent accounts that require a minimal investment of less than $10. By eliminating existing entry barriers through this distinctive approach, the broker has enabled countless new traders to enter Forex trading – an arena previously reserved for exclusive players only.

Driven by customer satisfaction and determined to surpass established competitors’ standards, the broker quickly stood out as a trailblazer in the field. Throughout its history, the company has garnered various accolades that have cemented its position as a preeminent global broker. Their exceptional trading platforms, fair spreads, and unwavering commitment to transparency have all been recognized.

Introducing their ground-breaking cTrader platform – celebrated for user-friendliness and top-notch charting capabilities – empowers traders at every level with access to cutting-edge technology.

The broker has become a renowned multinational brokerage firm that caters to clients worldwide, with an unwavering pledge to offer just and truthful trading opportunities forming the foundation of its culture. The company’s diverse portfolio comprises various account types, superior execution models, and extensive education resources illustrating this focus.

LiteFinance Summary

| 🗓 Established Year | 2005 |

| ⚖️ Regulation and Licenses | CySEC |

| 🪪 Ease of Use Rating | 4/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5, LiteFinance Social Platform, LiteFinance Mobile App |

| 🛍 Account Types | ECN, Classic |

| 🤝 Base Currencies | AUD, EUR, GBP, NZD, USD, CHF, CAD |

| 📊 Spreads | 0.0 pips |

| 📈 Leverage | 1:500 |

| 💸 Currency Pairs | 56; minor, major, and exotic pairs |

| 💳 Minimum Deposit | 50 USD |

| 🚫 Inactivity Fee | Yes, 10 USD after two months of inactivity on accounts with a <$100 balance |

| 🗣 Website Languages | English, Indonesian, Russian, Malay, Thai, Spanish, French, Portuguese, Chinese (Simplified), Arabic, Persian |

| 💰 Fees and Commissions | Spreads from 0.0 pips, commissions from $0.25 per share |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | Residents of EEA countries, the United States, Russia, Japan, Israel, and other regions. |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, commodities, index CFDs, energies, precious metals, shares |

| 🎖 Open an Account | Open Account |

Account Types

| ECN | Classic | |

| ✅ Availability | All; ideal for scalpers and day traders | All; ideal for casual traders |

| 🛍 Markets | All | All |

| 💸 Commissions | $0.25 per share $0.5 per Contract on Stock Indices $0.5 per lot on Energies $10 on Forex Major Pairs $20 on Forex Crosses $20 on Precious Metals $30 on Forex Minor Pairs 0.12% on Cryptocurrencies |

None; only the spread is charged |

| 💻 Platforms | All | All |

| 📊 Trade Size | 0.01 lots – 100 lots | 0.01 lots – 100 lots |

| 📈 Leverage | 1:1 – 1:500 | 1:1 – 1:500 |

| 💰 Minimum Deposit | 50 USD | 50 USD |

| 🎖 Open an Account | Open Account | Open Account |

ECN Account

Experienced traders seeking market execution with minimal spreads starting at 0.0 pips in exchange for the commission will find the ECN Account ideal. This account offers leverage of up to 1:500 and requires a minimum deposit of $50, providing direct access to liquidity providers. Traders can trade Forex, shares, commodities, indices, and social trading using MetaTrader 4 and 5 platforms.

The benefits include customizable lot size beginning at as low as 0.01 units alongside diverse choice base currencies while also enjoying negative balance protection- making it an attractive option for serious investors looking beyond traditional investment vehicles.

Classic AccountTailored for individual traders, the Classic Account eliminates commission fees and provides flexible spreads from as low as 1.8 pips. This account type covers various trading products and platforms, such as MT4, MT5, and LiteFinance’s exclusive social trading platform. Traders can enjoy leverage up to 1:500 with only a $50 minimum deposit while being assured of no hidden charges – perfect for those who value transparency in pricing strategies.

On top of that, this account offers negative balance protection plus Islamic account conversion options alongside access to informative materials – attracting like-minded learners who appreciate openness about how their trades are executed at every step.

Demo Account

With the Demo Account, traders can practice and experiment with strategies without any financial risk. The platform allows access to MT4 and MT5 using virtual money, which accurately simulates the actual market situation.

Since this demo account has no expiration date, it serves as an ideal tool for continuous learning. With real-time market data, traders can try various platforms and instruments until they become confident. This teaching resource is essential for beginners looking to gain confidence while enabling experienced professionals to test new methods without risking their finances.

Islamic Account

The broker offers an Islamic Account tailored for Sharia-compliant traders with no interest obligations.

This swap-free solution applies to two account types – ECN and Classic – ensuring ethical trading principles by removing rollover interest charges on overnight holdings in alignment with the standards of Islamic finance. Not only does this account maintain a consistent leverage ratio, execution quality, and access to all products included as standard accounts, but it also eliminates spread-widening measures.

The inclusive system permits Muslim traders unrestricted market engagement without compromising their religious beliefs or values.

Deposit & Withdrawal Options

| 💳 Payment Method | 🏛 Country | ⚖️ Currencies Accepted | ⏰ Processing Time |

| Debit/Credit Card | All | Multi-currency | Unpublished by broker |

| Bank Wire Transfer | All | Multi-currency | Unpublished by broker |

| Perfect Money | All | Multi-currency | Unpublished by broker |

| M-PESA Kenya | Kenya | KES | Unpublished by broker |

| M-PESA Tanzania | Tanzania | TZS | Unpublished by broker |

| Africa Mobile Money | Ghana | GHS | Unpublished by broker |

| ADVCash | All | Multi-currency | Unpublished by broker |

Trading Instruments & Products

The broker offers the following trading instruments and products:

➡️Forex – The broker offers a comprehensive choice of 56 currency pairings, including major, minor, and exotic pairs, enabling traders to capitalize on global foreign exchange market dynamics. This extensive variety allows traders to participate in strategies across several markets, from the most traded pairings, such as EUR/USD, to less prevalent exotic pairs, diversifying their trading portfolio.

➡️Precious Metals – Traders can trade five precious metals, which normally include gold and silver but may also include platinum and palladium. These assets are often employed to hedge against inflation and currency depreciation, providing a haven alternative during economic turmoil.

➡️Energies – Overall, he broker allows you to trade two types of energy products: crude oil and natural gas. These commodities are very volatile, creating many trading opportunities, and are critical for traders wishing to diversify their tactics beyond forex and metals.

➡️Global Stock Indexes – With 11 global stock indexes, traders may bet on wider equity market trends without trading individual equities. These indexes often contain benchmarks such as the S&P 500 and NASDAQ, which reflect important market sectors and economies.

➡️CFD on Indices – CFDs on indices allow traders to speculate on the price movement of an index without owning the underlying assets, providing a mechanism to trade on the overall performance of an index.

➡️Cryptocurrencies – Additionally, the broker offers a diverse range of 65 cryptocurrencies for trading, allowing access to one of the most active and quickly increasing marketplaces. This enables traders to speculate on the price swings of various digital currencies, including Bitcoin, Ethereum, and others, catering to the rising interest in cryptocurrency.

MetaTrader 4

The MT4 trading platform is renowned for its intuitive interface and impressive functionality.

Traders of all levels benefit from the extensive selection of analytical features, including 50+ pre-installed indicators, nine timeframe options for in-depth price analysis, and many drawing tools. The secure connection offers convenience with one-click trades and automated trading capabilities via Expert Advisors. At the same time, MetaTrader Market access provides additional resources to enhance your experience within the MQL4 community network.

The built-in encryption ensures safe transaction processing, further solidifying the broker’s reputation as a reliable trader choice.

MetaTrader 5

The broker offers traders seeking a comprehensive multi-asset platform that covers forex, equities, and commodities through CFDs the sophisticated features and capabilities of MetaTrader 5.

Boasting advanced analytical tools such as an economic calendar with 21 timeframes over 80 technical indicators for thorough market studies, MT5 is far superior to its predecessor. With complete support for various order types, including trailing stop orders, and extensive EA testing abilities via its strategy tester feature, it is perfect for those looking to test their strategies while enjoying maximum functionality in trading operations.

cTrader

cTrader’s intuitive and user-friendly interface is famous for facilitating speedy order execution and delivering advanced charting functionalities. Furthermore, many traders prefer this platform due to its superior order capabilities and Level II pricing – two features resonating with LiteFinance’s commitment to offering transparent prices and lightning-fast transaction processing.

Additionally, cTrader comes packed with comprehensive analytical tools and extensive charting suites- perfect supplements for scalpers and day traders seeking enhanced support from the broker while employing their trading strategies.

Trading App

The Trading App is designed for forex traders who prefer the convenience of portable devices. This mobile solution makes monitoring accounts and making trades while on the go even more accessible.

The app incorporates essential functionalities such as live quotes, interactive charts, and an extensive suite of trading orders that align with LiteFinance’s dedication to providing a dynamic trading experience. In addition, traders can access markets efficiently through its user-friendly interface, utilizing analytical tools at any time from anywhere they may be located to manage their investments effectively.

Social Trading Platform

The Social Trading Platform offers a unique solution for traders to emulate and replicate the strategies of skilled market players within LiteFinance’s network.

This platform is perfect for novice or seasoned traders seeking alternative trading methods by leveraging collaborative knowledge from a community of experts. The tool is an ideal supplement to their education-based approach; it provides insights into trader performance evaluation and risk mitigation measures while providing realistic learning opportunities with potential profits.

Additionally, integrating social elements in this process bolsters inclusivity and democratization – making trading more accessible and engaging.

Spreads

The spread system is designed to cater to a wide range of traders, offering competitive advantages that are especially advantageous for those using their ECN account. With spreads starting as low as 0.0 pips, this narrow margin can be incredibly beneficial for high-volume traders and individuals utilizing techniques like scalping, where each pip becomes significant.

For Classic account holders who prefer commission-free trading or infrequent trades, the company offers spreads beginning at 1.8 pips. The variety of available spreads highlights LiteFinance’s dedication to accommodating diverse styles and methods in trading while also providing value for both cost-conscious customers and casual investors alike.

Commissions

The broker offers commission costs tailored to suit the needs of active and professional traders, with fees starting at $0.25 per share on their ECN account. This demonstrates LiteFinance’s commitment to providing an affordable trading environment for its users. The commission charges depend upon the type of product traded – major Forex pairs incur a cost as low as $10- in line with LiteFinance’s fair and transparent pricing approach.

By adopting this model, traders can effectively monitor their anticipated transaction expenses, thereby gaining control over their overall spending while executing trades accurately within budget constraints.

Overnight Fees

Overnight fees impact traders who hold positions open for more than a day. The costs may fluctuate according to market conditions, potentially impacting forex strategy. Traders should note the trading platform’s opportunity for triple swaps on Wednesday and Thursday evenings, as this could affect profitability through increased fees.

With its transparent fee structure, the broker enables traders to anticipate potential transaction expenses and plan accordingly.

Leverage and Margin

Overall, the broker offers leverage and margin trading as important features of its forex and cryptocurrency trading platform. Additionally, the company explains that leveraging is like a loan given by the broker to traders in the realm of forex trading.

This method allows them to take on positions much larger than their initial investment, leading to significant gains or losses depending on market fluctuations. With LiteFinance’s 10:1 leverage ratio, for instance, traders could manage trades with an amount ten times greater than what they initially invested. While high leverages present more opportunities for savvy traders looking to maximize profits from smart trades, they raise asset risk levels significantly.

In contrast, margin trading involves acquiring financial products through borrowed funds from a broker. Initially implemented in stock transactions, this notion has been broadened by the broker to incorporate numerous digital assets and empower traders with leveraged positions in cryptocurrency markets. The provision of margin trading for crypto-assets exemplifies LiteFinance’s commitment to providing traders access to top-notch tools while facilitating leverage over volatile markets. Leveraging and margin trading are both important techniques for traders looking to expand their market exposure and increase potential earnings.

However, they must be aware of the risks involved in these methods that could amplify profits and losses. To make sure traders understand leverage and margin trading fundamentals before engaging in such high-risk yet rewarding tactics, they provide educational resources.

Educational Resources

The broker offers the following educational resources:

➡️LiteFinance Webinars – Moreover, these online seminars dive into Forex market theory and practice, given by expert traders with vast experience. The webinars are designed to assist traders in making educated judgments, answer tough queries, and grasp key trading principles.

➡️Forex Glossary – Overall, this is a comprehensive collection of Forex words and concepts that may help traders educate themselves with the specialized language used in forex trading.

➡️Forex books – The broker suggests books that provide insights into Forex from the viewpoint of expert traders. This may be very valuable for improving your market comprehension and trading abilities.

➡️Trading Strategies from Professional Traders – Additionally, the site allows users to access a variety of trading strategies offered by experienced traders, as well as practical information and approaches for use in various market conditions.

➡️Trader Reviews – Overall, traders may access reviews and comments from other users, creating a forum for community learning and sharing experiences.

➡️Demo Account – The broker provides a demo account feature that allows traders to test their trading methods in a risk-free environment using virtual money. This is especially advantageous for beginner traders who want to acquire expertise without financial risk.

➡️FAQ section – Moreover, a well-organized FAQ section covers typical inquiries and offers rapid answers to various issues or questions that traders may have concerning LiteFinance’s services and operations.

Security Measures

Overall, the broker employs rigorous security measures to safeguard its customers and provide a safe trading environment.

Firstly, they keep segregated accounts, keeping client funds separate from the company’s operating funds. This segmentation is critical when the firm has financial problems since it safeguards customers’ money. Furthermore, the broker is a member of the Investor Compensation Fund (ICF), which adds extra financial protection. The ICF seeks to reimburse customers if the company fails to meet its financial responsibilities, covering up to 20,000 EUR per client and providing a substantial safety net.

To secure customers’ data and transactions, they use an SSL certificate, which ensures that all data passed via its website is encrypted, preventing other parties from capturing sensitive information. Furthermore, the broker provides Two-Factor Authentication, which needs not just a password and username but also something only the user has, such as a physical token. A clear and thorough privacy policy is in place, describing how customer data is gathered, handled, and safeguarded. The company also issues risk alerts to traders to assist them in understanding the possible hazards involved with trading activity.

Finally, the broker provides Negative Balance Protection, guaranteeing that customers cannot lose more than their account balance. This is especially crucial in highly volatile trading settings when market moves might be unforeseen.

Up to :

1:500 leverage

Min Deposit : $50

A fixed commission in currency is indicated per 1 lot.